In the fast-paced world we live in, every minute counts, and so does every dollar. Whether you’re a small business owner, a freelancer, or just someone who uses their vehicle for work purposes, keeping a mileage log is a crucial practice that can save you both time and money. In this article, we’ll delve into the importance of maintaining a mileage log, how it can benefit you, and provide practical steps on getting started, all while highlighting the innovative features of the MileageWise app.

Understanding the Mileage Log

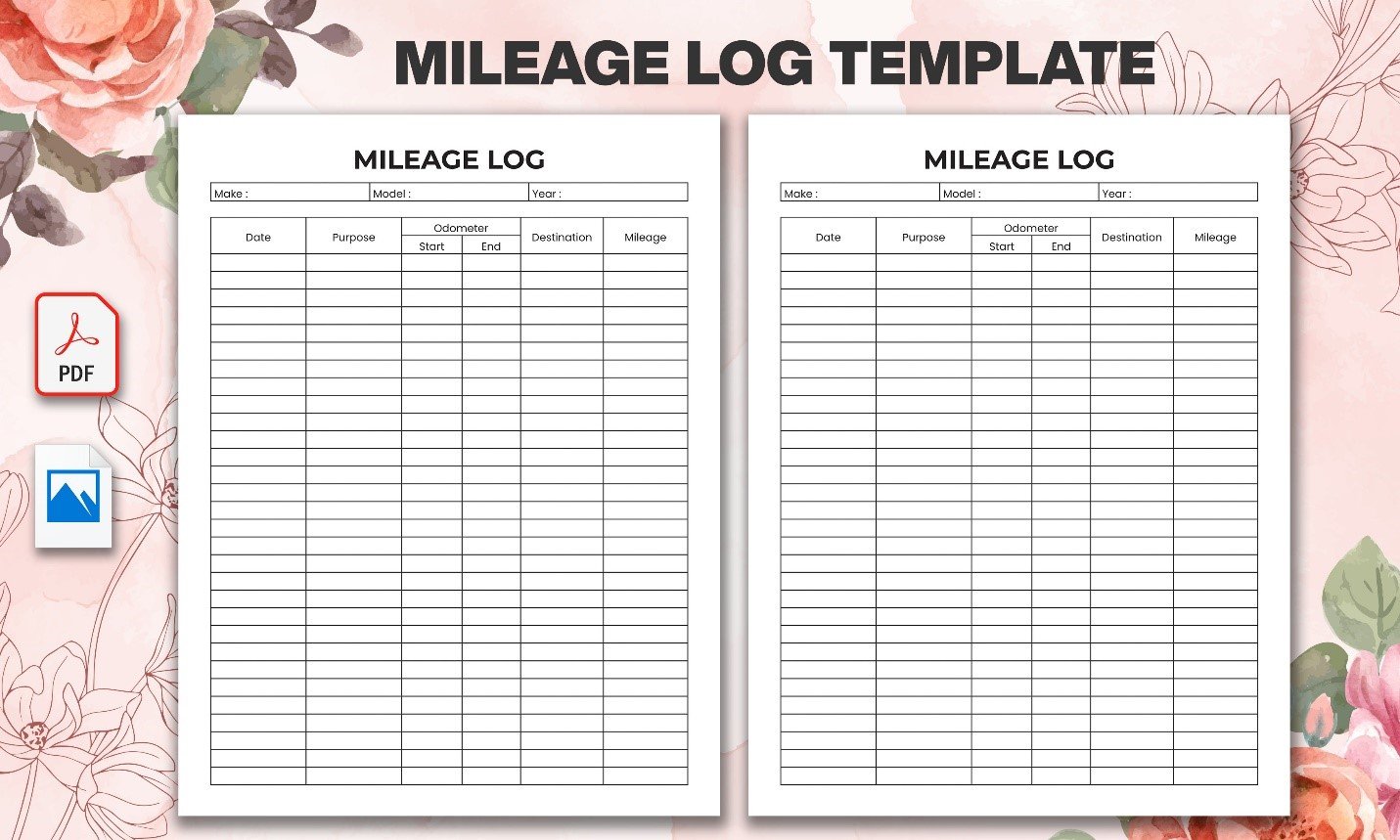

A mileage log is a record of the miles you drive for business or work-related purposes. This log serves as a comprehensive document that includes details such as the date, starting and ending locations, purpose of the trip, and the total miles traveled. Having an accurate and up-to-date mileage log is essential for various reasons, and it’s not just about complying with tax regulations.

Why You Need a Mileage Log

- Tax Deductions and Savings: One of the primary reasons for maintaining a mileage log is to claim tax deductions. For businesses and self-employed individuals, every mile driven for work-related activities can translate into significant savings. The MileageWise app, with its AdWise feature, ensures you don’t miss any forgotten trips, potentially leading to additional deductions.

- Legal Compliance: Keeping a mileage log is not just a best practice; in many cases, it’s a legal requirement. Tax authorities may request documentation to support your business-related deductions, and a detailed mileage log can serve as irrefutable evidence.

- Expense Tracking: For businesses that reimburse employees for mileage, a mileage log is indispensable for accurate expense tracking. It helps businesses manage their budgets efficiently and ensures employees are fairly compensated for their travel-related expenses.

How to Get Started with Your Mileage Log

Now that we understand the importance of a mileage log, let’s explore how you can create and maintain one seamlessly:

- Choose a Reliable Mileage Tracker App: With technological advancements, manual record-keeping is a thing of the past. Opt for a mileage tracker app like MileageWise, which offers features like AdWise for forgotten trips, logical conflict monitoring, and ensures $7,000 in deductions.

- Set Up Your Profile: Start by entering your personal and vehicle details. This step is crucial for accurate mileage tracking and for generating reports when needed.

- Record Your Trips Promptly: Develop a habit of recording your trips immediately after they occur. The MileageWise app, with its user-friendly interface, allows you to log your trips in just 7 minutes per month.

- Regularly Review and Edit Entries: Periodically review your mileage log to ensure accuracy. The MileageWise app, with its logical conflict monitoring, helps identify and resolve any inconsistencies in your records.

- Generate Reports for Tax Purposes: At the end of each tax year, use the app to generate comprehensive reports for tax purposes. Having a well-organized and detailed mileage log simplifies the tax filing process and ensures you maximize your deductions.

Conclusion

In conclusion, a mileage log is not just a mundane task but a strategic move to save time, money, and stay compliant with tax regulations. Embrace the convenience of modern technology with a reliable mileage tracker app like MileageWise, and experience the ease of managing your business-related travel efficiently. Start your journey towards $7,000 in deductions and a hassle-free mileage log in just 7 minutes per month. Visit MileageWise today to explore the AdWise feature and revolutionize your mileage tracking experience.