The world of cryptocurrency is evolving at lightning speed, and one of the most revolutionary innovations in this space is the rise of Instant Exchange platforms. These platforms are redefining how digital assets are traded, allowing users to swap cryptocurrencies within seconds without the need for traditional trading pairs, order books, or lengthy registration processes. As blockchain technology continues to mature, Instant Exchange systems are becoming central to the new era of decentralized finance (DeFi). This article explores how crypto swaps are evolving, the technology driving instant exchanges, and what the future holds for traders and investors alike.

The Evolution of Crypto Trading

In the early days of cryptocurrency, trading digital assets was a complicated process. Users had to rely on centralized exchanges, which required creating accounts, verifying identities, and waiting for transactions to process. These platforms acted as intermediaries, holding users’ funds and executing trades on their behalf. While functional, they came with significant drawbacks such as security risks, limited liquidity, and delays in transactions.

As blockchain adoption grew, so did the need for faster, more secure, and decentralized trading methods. This led to the creation of decentralized exchanges (DEXs) that allowed peer-to-peer trading without middlemen. However, even DEXs initially faced issues such as slow transaction times, high gas fees, and complex user interfaces. The next step in this evolution was the emergence of Instant Exchange technology—platforms that merged the speed of centralized systems with the security of decentralized networks.

Understanding Instant Exchange Technology

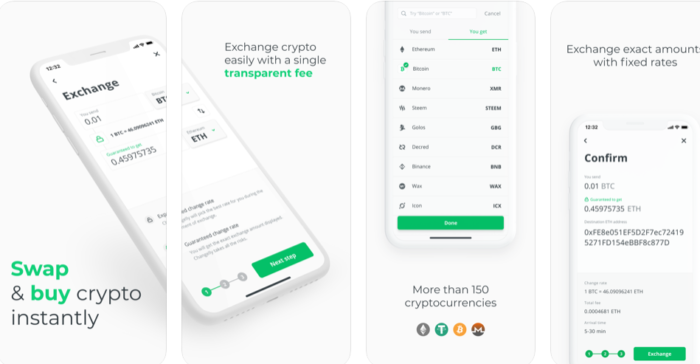

Instant Exchange platforms are designed to make crypto swaps simple and immediate. Instead of manually searching for trading pairs or waiting for buyers and sellers to match orders, users can swap one cryptocurrency for another instantly at the best available market rate. The process typically involves three main steps: selecting the coins to exchange, confirming the rate, and executing the transaction.

Behind the scenes, Instant Exchange technology works by aggregating liquidity from multiple sources, including centralized exchanges, decentralized liquidity pools, and automated market makers (AMMs). This ensures users always get competitive rates and fast execution. The exchange platform acts as a bridge, routing transactions through the most efficient channels without requiring users to manage wallets on multiple platforms.

One of the major advantages of Instant Exchange systems is that they are non-custodial. This means users maintain full control over their funds throughout the swap process, minimizing the risk of hacks or loss due to exchange failures. Funds move directly from the sender’s wallet to the receiver’s wallet via smart contracts or atomic swaps, ensuring transparency and security.

The Role of Atomic Swaps and Smart Contracts

A key component of modern Instant Exchange technology is the atomic swap—a mechanism that enables direct peer-to-peer trading between two cryptocurrencies on different blockchains without intermediaries. Atomic swaps rely on smart contracts and cryptographic techniques to ensure that both sides of the trade occur simultaneously or not at all. This eliminates counterparty risk, making the process more secure and efficient.

Smart contracts, which are self-executing agreements stored on the blockchain, play a critical role in automating and enforcing these swaps. When a user initiates a trade, the smart contract locks the funds until both parties fulfill the agreed conditions. Once the contract verifies that everything is in order, it releases the assets to the respective wallets instantly. This process not only saves time but also removes the need for trust between traders.

The Benefits of Instant Exchange Platforms

Instant Exchange systems offer several advantages that appeal to both novice and professional crypto traders:

1. Speed and Convenience – Traditional exchanges can take minutes or even hours to process transactions, especially during peak trading periods. Instant Exchange platforms, however, complete swaps within seconds, providing users with immediate access to their new assets.

2. Security and Privacy – Since these platforms are often non-custodial, users never have to deposit funds or share private keys. This greatly reduces exposure to hacks and protects user privacy.

3. Access to Multiple Assets – Instant Exchange services aggregate liquidity from various exchanges and blockchains, giving users access to hundreds of cryptocurrencies in one place.

4. No Registration or KYC Hassles – Many Instant Exchange platforms do not require users to create accounts or undergo lengthy verification processes, allowing for greater anonymity and ease of use.

5. Best Market Rates – By pulling data from multiple sources, these platforms ensure users receive the most competitive rates available at the moment of the swap.

How Instant Exchange Is Powering the DeFi Revolution

The rise of decentralized finance has been one of the most significant movements in the crypto industry, and Instant Exchange technology is a key enabler of this transformation. DeFi platforms depend on interoperability between blockchains and fast, efficient asset swaps to facilitate lending, staking, yield farming, and other financial activities. Instant Exchange services make it easy for users to move assets between networks without delays or high transaction costs.

Moreover, the integration of cross-chain bridges with Instant Exchange functionality has opened the door to a truly interconnected blockchain ecosystem. Users can now swap tokens between Ethereum, Binance Smart Chain, Polygon, Avalanche, and other networks seamlessly. This fluidity is vital for expanding DeFi use cases and attracting more participants to the crypto economy.

The Future of Instant Exchange and Crypto Swaps

The future of crypto swaps is inseparable from the evolution of Instant Exchange technology. As blockchain scalability improves and new interoperability protocols emerge, we can expect even faster and more cost-efficient swaps. Layer 2 solutions like Optimistic Rollups and zk-Rollups are already enhancing transaction speeds while reducing fees, paving the way for broader adoption.

Artificial intelligence and machine learning are also set to play a role in optimizing Instant Exchange systems. By analyzing real-time market data, AI algorithms can predict liquidity shifts and automatically adjust routing paths for the best trade execution. This will further improve accuracy, reduce slippage, and enhance user experience.

Additionally, regulatory clarity will likely shape how Instant Exchange platforms operate in the future. As governments and financial authorities develop clearer frameworks for digital asset trading, compliant instant swaps could bridge the gap between traditional finance and decentralized ecosystems.

Another emerging trend is the integration of Instant Exchange features directly into digital wallets and payment apps. Imagine being able to convert Bitcoin to Ethereum instantly within your wallet, or paying for goods in one currency while the merchant receives another—all powered by instant swap technology running silently in the background. This vision is rapidly becoming reality as more developers incorporate instant swapping capabilities into their products.

Challenges and Considerations

Despite their many benefits, Instant Exchange platforms still face several challenges. Liquidity fragmentation remains a key issue, as not all assets have deep enough markets to support truly instant execution. Cross-chain compatibility can also be complex, especially when dealing with blockchains that use different consensus mechanisms.

Moreover, user education is essential. Many new crypto users may not fully understand how Instant Exchange systems work or the importance of verifying wallet addresses before confirming swaps. Building intuitive interfaces and transparent fee structures will be crucial for long-term trust and adoption.

Conclusion

Instant Exchange technology represents the next frontier in cryptocurrency trading. By combining speed, security, and decentralization, these platforms are making crypto swaps more efficient and accessible than ever before. As blockchain infrastructure continues to evolve and integrate across networks, the future of crypto swaps looks increasingly seamless and interconnected.